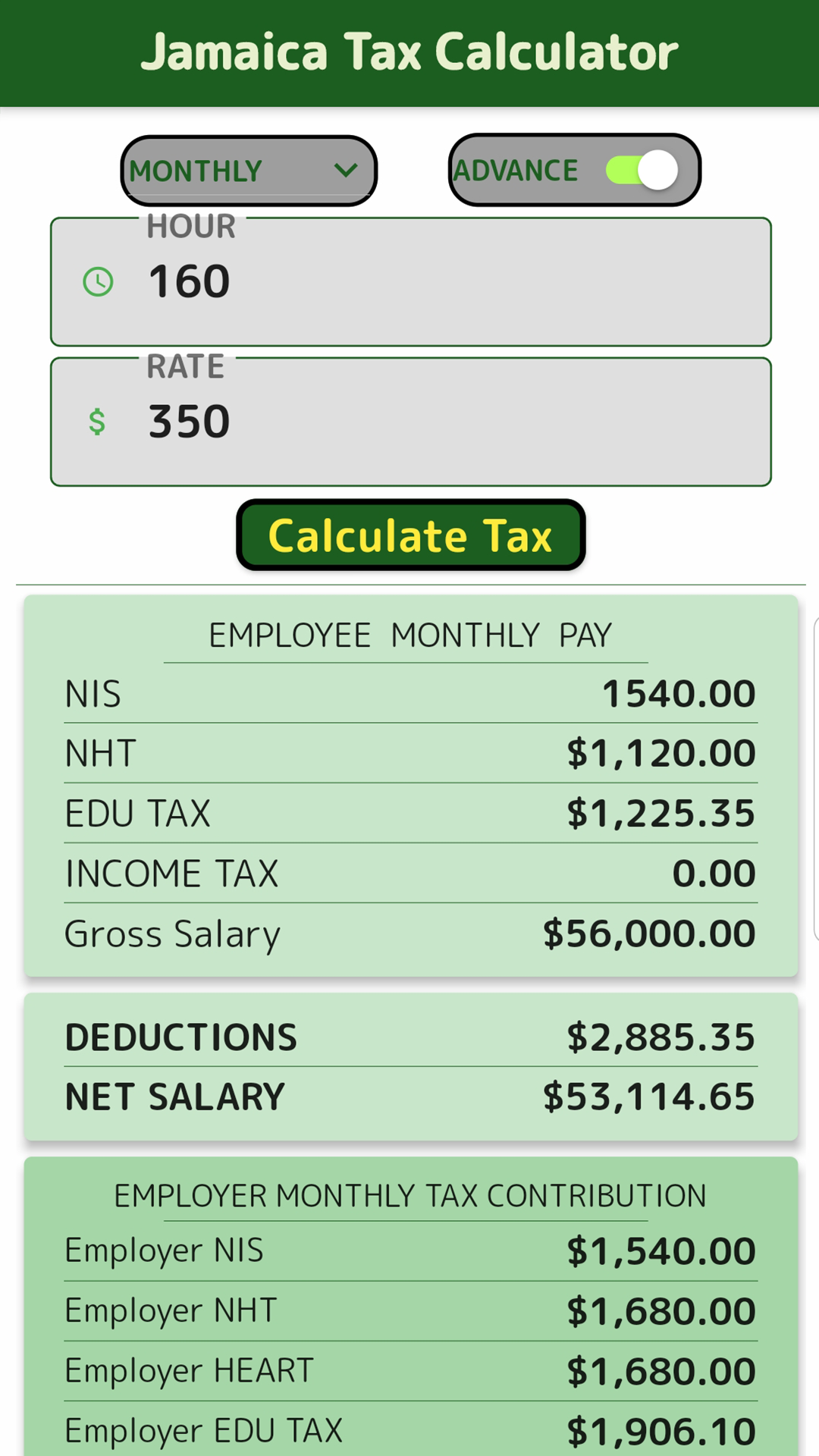

Payroll city tax calculator

Customized for Small Biz Calculate Tax Print check W2 W3 940 941. 2020 Federal income tax withholding calculation.

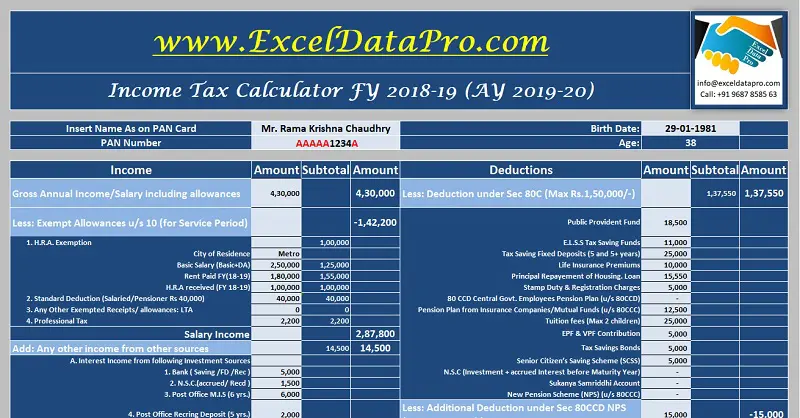

Download Income Tax Calculator Fy 2018 19 Excel Template Exceldatapro

14 days in a bi-weekly pay period.

. Calculating Annual Salary Using Bi-Weekly Gross. The standard FUTA tax rate is 6 so your. Ad Compare This Years Top 5 Free Payroll Software.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Plug in the amount of money youd like to take home. Annual Salary Bi-Weekly Gross 14 days.

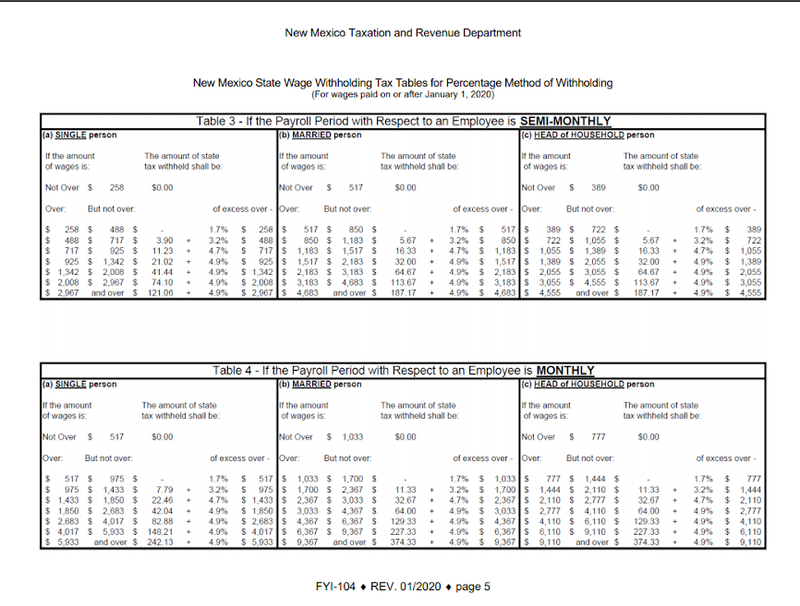

Just enter the wages tax withholdings. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Subtract 12900 for Married otherwise.

Taxable income Tax rate Tax liability Step 5 Additional withholdings Once you have worked out your tax liability you minus the money you put aside for tax. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Your employer withholds a 62 Social Security tax and a.

Subtract any deductions and. 365 days in the year please use 366 for leap years Formula. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and other specialty.

Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Ad Payroll So Easy You Can Set It Up Run It Yourself. Free Unbiased Reviews Top Picks.

This number is the gross pay per pay period. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Could be decreased due to state unemployment.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Free Unbiased Reviews Top Picks. If you live in a.

New York Paycheck Calculator Use ADPs New York Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. All Services Backed by Tax Guarantee. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

Medicare 145 of an employees annual salary 1. Ad Compare This Years Top 5 Free Payroll Software. Unemployment insurance FUTA 6 of an employees first 7000 in wages 2022 2.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

How To Calculate Taxes On Payroll Clearance 58 Off Www Ingeniovirtual Com

Personal Income Tax Solution For Expatriates Mercer

Payroll Tax Calculator For Employers Gusto

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Gross Pay And Net Pay What S The Difference Paycheckcity

New Tax Calculator Shows Taxpayers Their Tax Bill Under Many Scenarios Tax Foundation

Payroll Tax What It Is How To Calculate It Bench Accounting

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

Tax Calculator With Deductions Outlet 50 Off Www Ingeniovirtual Com

Paycheck Calculator Take Home Pay Calculator

1wxmydejhzto9m

Calculating Federal Taxes And Take Home Pay Video Khan Academy

Payroll Tax Engine Symmetry Tax Engine

Federal Income Tax Fit Payroll Tax Calculation Youtube

Paycheck Calculator Take Home Pay Calculator

Free Online Paycheck Calculator Calculate Take Home Pay 2022